|

This article originally appeared in Geospatial Solutions Magazine's Net Results column of February 1, 2001. Other Net Results articles about the role of emerging technologies in the exchange of spatial information are also online. |

| 1. Introduction and Glossary 2. World Market 3. US Market 4. Future of LBS 5. Place in the Choir | |

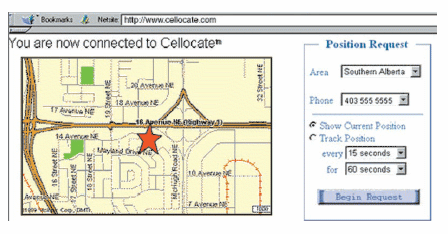

| Genesis of U.S. LBS Although it might have happened on its own in the United States (as it has in Europe and Japan), the technological advances that enable LBS are being driven in part by the FCC s 1996 mandate (Docket 94-102) that wireless carriers must provide a method for locating mobile 911 calls by fall 2001. E911 callers are not always lucid or relaxed enough to communicate their address to a calltaker, but databases of phone number and address pairs maintained by local telephone exchange carriers remedy this problem for fixed-position land-line phones. Even when callers can say where they are, the E911 call center checks the database for confirmation. Docket 94-102 is the FCC s attempt to solve the same problem for mobile phones, which account for more than 100,000 of the daily E911 calls in North America. The mandate requires that covered carriers be able to identify the latitude and longitude of a mobile unit making a 911 call, within a radius of no more than 125 meters in 67 percent of all cases. If 125 meters seems like a large radius, consider that some callers may be in motion when they place the call, in which case the location returned by the carrier will be inaccurate before it even arrives at the E911 center. Details aside, though, Docket 94-102 has encouraged lively cooperative efforts between the FCC s targeted participants (PSAPs, wireless carriers, state and local governments, and equipment manufacturers) and others, resulting in not one but several strategies for returning the location of a mobile device (to be covered in next month s Net Results column). Assured that location information will eventually be standard to all mobile devices, LBS players are eagerly partnering and promoting their solutions. Let there be a U.S. market Although more fragmented than Japanese or European markets, the United States cellular/PCS market sometimes leads the world as happened at the end of 1999 when the U.S. reported more than 75 million subscribers. But, according to Alistair Adams of Open Wave Systems Inc. (www.openwave.com), formerly Phone.com and Software.com, whose work takes him back and forth between the continents, the United States lacks technical standardization compared with the United Kingdom and operates under a fundamentally different economic model. The U.S. has maintained the concept that local calls are free whereas Europe has maintained the concept that the receiving party doesn t pay, says Adams. Therefore, teenage use is much higher in Europe than it is in America in England, you can walk into a petrol station, buy a $45 phone across the counter, and be instantly up and running without any future charges to worry about. To make outgoing calls, European teens can use their home phones, paid for by Mom and Dad, but place calls to their mobile friends, who leave their phones on all the time without fear of charges due to incoming calls. Although American teenagers cannot typically afford the cost of cellular service, a study by the market research firm Cahners In-Stat Group (www. instat.com), found that parents are often willing to foot the bill to keep track of their teenagers. The study predicts the wireless market for American young people ages 10 24 will grow from 11 million subscribers today to 43 million by 2004. Give us this day our daily position The U.S. LBS market remains primarily promotional pending the arrival of the FCC-mandated solution. In general, most North American companies offer LBS packages similar to Webraska s in its consumer-oriented functions. Noteworthy is the Canadian company Cell-Loc (www.cell-loc.com), which also offers a fleet-tracking service developed by its subsidiary, TimesThree (www.timesthree.com). Unlike location services in Europe, TimesThree s application allows anyone with a password and an Internet browser to track the entire path, not just the current position, of a fleet of mobile units contingent only on each driver carrying a mobile phone. The potential benefits of such a service are added employee safety and security, better routing and scheduling, and informed customer service. For a sequential demonstration of Cell-Loc s Internet-based location monitoring service, visit www.cell-loc. com/mdnews/demo/locdemo1.html (see Figure 6). Keep it to thine self. An LBS that lets someone else inexpensively monitor your whereabouts from the comfort of their desktop Web browser will be welcomed by trucking organizations and the paranoid parents of unruly teenagers, but it also raises a frequently asked question about LBS What about the privacy of the mobile device owner? Another North American LBS promoter, SnapTrack (www.snaptrack.com), claims its technology protects personal privacy while still providing location information during emergencies. Snap- Track users can choose to activate their device s locator only when dialing 911 or when they require a location service. (Of course, they could also simply turn off the phone, but at the loss of incoming call reception.) Other locator strategies currently in development use the cellular network itself to capture a device s coordinates, and thus can track devices continuously, without subscriber knowledge or permission. (Read next month s Net Results for an explanation of coordinate capture methods.) |

|

| Figure 6: The results of a simulated cell-phone search using the Internet-based service from Cell-Loc, viewable at www.cell-loc.com/mdnews/demo/locdemo1.html. |

| 1. Introduction and Glossary 2. World Market 3. US Market 4. Future of LBS 5. Place in the Choir |

|

|