|

This article originally appeared in Geospatial Solutions Magazine's Net Results column of January 1, 2002. Other Net Results articles about the role of emerging technologies in the exchange of spatial information are also online. |

| 1. Introduction and Glossary 2. Spawn of the TIGER 3. Species Specialization 4. Surveying the Territory | |

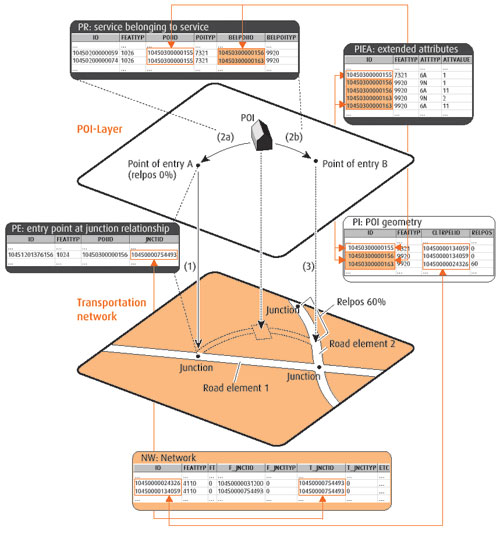

| Species specialization. Even though their products share a common origin and are similar in many ways, the big three spatial data vendors have since differentiated themselves within the spatial market. GDT caters to the appetite of the traditional GIS user by promoting the extensive thematic content of its data. Today, GDT leads in the variety of spatial themes offered, supplying boundary and point data for telecommunications mapping and territory boundaries for insurance firms, among others. Navtech has always pursued the vehicle-navigation market, a strategy requiring a much greater attention to detail than TIGER afforded, and necessitating its (now proudly self-proclaimed) "drive, drive, drive" turn-by-turn data-capture method. This meant that Navtech could only recently claim complete U.S. coverage, but it has also won them almost 100 percent of the U.S. automotive navigation systems market, seven of 10 European car brands, and at least 15 automotive partners from Acura to Volvo. With a foot in both the cartographic and navigational worlds, Tele Atlas has targeted analytically focused customers by strengthening its dataset's positional accuracy - ensuring a high geocoding match rate - and by refining its data model. Tele Atlas's European dataset, for instance, captures the entry points to important buildings, even specifying primary and secondary access (see Figure 1). Tele Atlas's sophisticated data model is the basis for its current effort to become a leader in real-time travel information and LBS markets.

So what? What makes any of these strategies newsworthy? Convergence and emergence. The convergence is the simultaneous maturation of wireless, handheld, and real-time tracking technologies. The emergence is of the spatio-temporal services business model. A real-world example (in non-market-speak) may help illustrate this trend. By the end of 2003, Ford plans to equip every vehicle it manufactures with an onboard GPS, not as an option, but as a standard feature. The convergence of wireless communications with affordable location-aware devices makes it technically possible for Ford to fill the world's highways with location-enabled moving objects. But how does Ford justify this business expense to its shareholders? The business model is founded on Ford's belief that drivers will pay for real-time navigation services, generating a revenue stream that keeps flowing long after the vehicle's purchase. Some calculations predict more profit from service income than from the new car sales. An October 2001, article in the Boston Globe quoted the subscription fee for "Virtual Advisor," a service from OnStar that supplies real-time traffic and navigation information, at $399 a year or $34.95 a month. The cellular minutes required to connect to Virtual Advisor cost extra, of course. Ford wants a piece of that pie as do the telecommunications carriers. The spatial data vendors are lining up as well. It's large, loose, and still-unfinished partnering between big players in hype-filled markets like LBS that I predict will be the sign of the times in 2002.

|

| 1. Introduction and Glossary 2. Spawn of the TIGER 3. Species Specialization 4. Surveying the Territory |

|

|